If you run a credit repair company, you know that lead intake is make‑or‑break. Whether you capture leads from ads, referrals, Google, or word of mouth, how you respond determines whether a lead becomes a paying client or slips through the cracks.

For years, credit repair businesses have relied on manual intake teams human staff or virtual assistants who answer calls, collect information, and follow up. But with the rise of AI technology, a new contender has emerged: AI calling.

Imagine leads being contacted instantly, in any time zone, even on weekends. Imagine follow‑ups happening automatically, without staff reminders. That’s what AI calling promises and right now, it’s transforming the way credit repair companies handle intake.

In this article, we’ll explore AI calling vs manual intake in depth, share real examples, pricing breakdowns, and practical insights so you can decide what makes sense for your business now and in the future.

Quick Takeaways

- AI calling responds immediately 24/7 — increasing lead contact rates and conversions

- Manual intake offers a personal touch but is costly and inconsistent

- AI calling significantly reduces operational costs and time spent on follow‑ups

- Manual intake still holds value for complex scenarios requiring empathy

- The smartest strategy often blends AI efficiency with human expertise

Why Intake Matters for Credit Repair

Before we dive into AI vs manual, let’s set the stage.

Lead intake is the very first business interaction your potential client has. It determines:

- Whether they are contacted at all

- How quickly you respond

- How accurately their information is captured

- Whether they trust you enough to schedule a consultation

- Whether they show up to that consultation

In credit repair, the faster and more consistently you respond, the more revenue you generate.

What credit repair companies have traditionally done:

✔ Hire staff

✔ Pay hourly or salary

✔ Train team members to answer calls and follow up

But in a business where most leads come in after hours or from online ads, manual intake creates bottlenecks and missed opportunities.

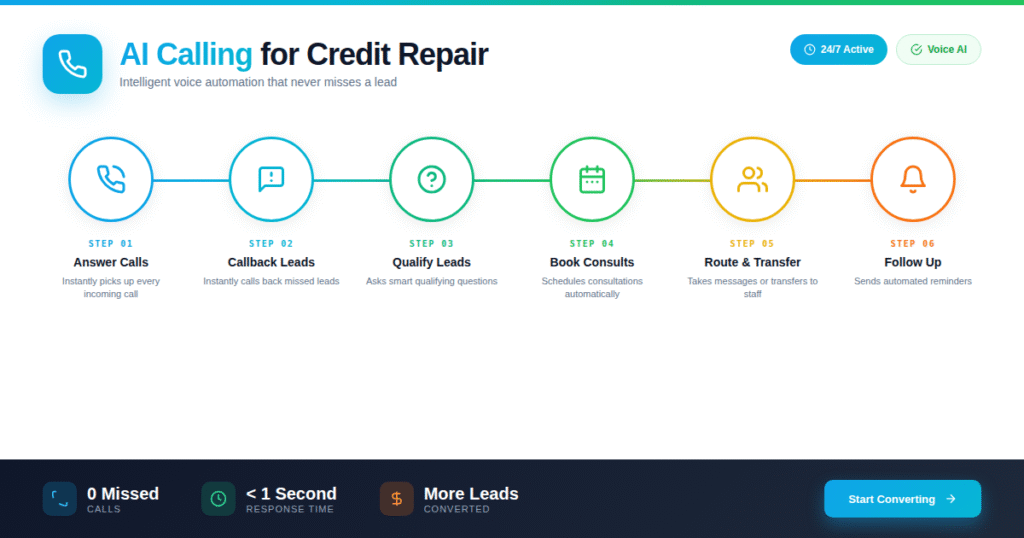

What Is AI Calling for Credit Repair?

AI calling uses advanced automated voice technology to interact with leads—without a human sitting at a phone.

Powered by natural language processing, AI callers:

- Answer incoming calls

- Call back missed leads instantly

- Ask qualifying questions

- Schedule consultations

- Take messages or transfer to staff when needed

- Follow up with reminders

All with a natural, conversational voice that doesn’t sound like a robot.

AI calling handles intake so that your human team can focus on what they do best — closing clients and delivering services.

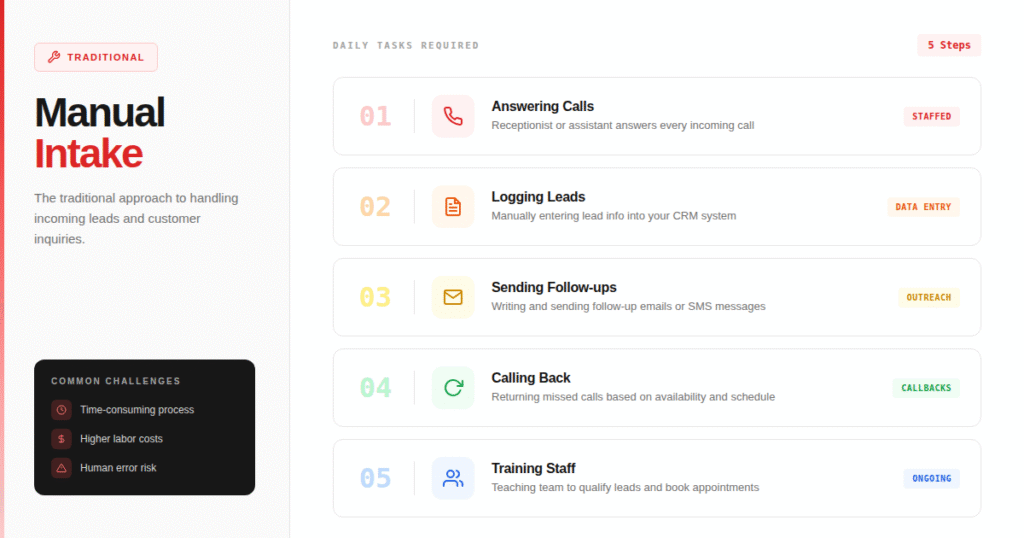

What Is Manual Intake?

Manual intake is the traditional way of handling leads.

It involves:

- Answering calls by a receptionist or assistant

- Manually logging leads into your CRM

- Sending follow‑ups via email or SMS

- Calling back missed calls based on the schedule

- Training staff to qualify and book appointments

Manual intake has been the norm for decades—but in today’s fast‑paced lead environment, it can struggle to deliver the responsiveness clients expect.

Side‑by‑Side Comparison

Let’s break down how AI calling compares to manual intake across key categories.

| Feature | AI Calling | Manual Intake |

|---|---|---|

| 24/7 Availability | Yes | No |

| Lead Contact Speed | Within seconds | Minutes to hours |

| Cost | Low (usage‑based) | High (hourly or salary) |

| Consistency | Very high | Varies by staff quality |

| Follow‑Ups | Automated, timely | Manual, often delayed |

| Scalability | Instant | Requires hiring |

| Language Support | English + Spanish (optional) | Depends on staff |

| Human Emotion | Synthetic but friendly | Authentic |

| Lead Qualification | Scripted logic | Skill‑dependent |

| Appointment Booking | Direct integration with calendar | Manual calendar handling |

The Real Business Impact

To see the difference clearly, let’s look at a practical example based on real data from credit repair companies.

Example Scenario

Your credit repair firm receives 150 new leads per month from Google and Facebook ads.

Manual Intake Result

- Only 40% of leads are contacted within the hour

- 35% of leads go cold before anyone responds

- 20 hours/week spent manually following up

- Estimated conversion rate: ~28%

- Support staff cost: $2,000/month

- Revenue (avg. $350/client): ~$14,700

AI Calling Result

- 100% of leads are contacted were attempted within seconds

- AI never sleeps—not even nights/weekends

- Phone scripts automatically qualify leads

- Appointment booking done in real time

- Estimated conversion rate: ~55%

- No hourly wages

- Revenue (avg. $350/client): ~$28,875

📌 Outcome: AI calling nearly doubles conversions and saves thousands each month.

How AI Calling Works Step‑by‑Step

Here’s what happens when a lead comes in, and AI calling is enabled.

1 Lead Capture

The moment a lead submits a form or calls, AI activates.

2 Immediate Contact

Instead of waiting for office hours, AI calls back instantly—even on weekends and evenings.

3 Qualification

AI asks scripted questions like

- “Are you looking to fix your credit now?”

- “Have you worked with a credit repair company before?”

- “What’s your main goal for your credit score?”

Responses are logged directly into your CRM.

4 Appointment Scheduling

Once qualified, AI:

✔ Checks your calendar availability

✔ Books the consultation

✔ Sends confirmation via SMS + email

No human input needed — unless a transfer is requested.

5. Follow-Up & Reminders

AI sends intelligent reminders:

- Day before appointment

- 2 hours before the appointment

- Auto reschedule if no‑show

- Reactivation call 7 days later

Pricing Breakdown

Here’s a clear look at typical pricing for each method.

AI Calling Costs

| Service | Price |

|---|---|

| AI Calling Per Minute | $0.12 per minute (est) |

| Avg minutes per lead (150 leads) | ~300 minutes total |

| Monthly AI calling cost | ~$36 |

| Setup with automation snapshot | $997 (one‑time) |

| Annual estimated cost | ~$432 + one‑time setup |

Manual Intake Costs

| Cost Element | Price |

|---|---|

| Intake rep salary/VA | $15–$22 per hour |

| Hours per week | 20 hours |

| Monthly intake cost | ~$1,200–$1,760 |

| Annual estimated cost | $14,400–$21,120 |

📌 Bottom Line: AI calling costs a tiny fraction of manual intake — without sacrificing responsiveness.

Practical Insights

Here are some real insights gained from credit repair companies using both systems.

Lead Contact Matters

Studies show that responding within the first 5 minutes increases conversion chances by over 21x.

AI calling ensures:

- No missed leads

- No voicemail delays

- Consistent follow‑up

Manual intake? Time gaps kill conversions.

Training Is a Hidden Cost

Manual intake success depends on training quality.

Training requires:

- Time from managers

- Hiring costs

- Ongoing coaching

- Quality assurance

These variables add cost and inconsistency.

AI calling scripts deliver repeatable results every time.

Human vs AI: When Emotion Matters

AI is efficient, but humans connect emotionally.

Use humans for:

- Complex discussions

- Sensitive financial nuances

- Building deep trust

Use AI for:

- First contact

- Lead screening

- Appointment booking

- Follow-up reminders

The best systems blend both.

Real Agency Stories

Here are two typical outcomes from agencies in the credit repair space.

Story 1: Small Business Owner

“Before AI calling, our team missed too many calls after hours. Leads were slipping through, and our costs were high. After implementing voice AI, we saw a 62% increase in booked consultations within the first month.”

— Maria L, Credit Repair Owner

Story 2: Agency Scaling Fast

“Our manual team got overwhelmed at scale. AI handling intake allowed our account managers to focus on closing deals. Revenue tripled within 90 days—and we cut intake costs in half.”

— Jordan P, Agency Founder

Frequently Asked Questions

Is AI calling hard to set up?

Will AI calling sound robotic?

Should I replace humans entirely?

Can AI handle follow‑ups?

Do I need special software?

Conclusion

When it comes to AI calling vs manual intake, the choice isn’t just about technology—it’s about results.

AI calling offers:

✔ Instant responsiveness

✔ Lower operational costs

✔ Scalable intake

✔ Better lead contact rates

✔ Consistent follow‑ups

Manual intake still has its place—especially when human judgment and emotional intelligence are needed—but for most credit repair companies, AI calling delivers far better ROI.

If you want faster lead contact, higher conversions, and a system that works around the clock, adopting AI calling is one of the smartest decisions you can make.